TES - heating up the energy storage world

1. A new player in the energy landscape

Our relationship with energy has always been complicated. Throughout history, control of energy in its various forms — from fire and labor (human or animal) to watermills, coal, oil, and nuclear — has defined prosperity and productivity. Yet for more than a century, we have shown limited will to evolve our energy sources and mitigate their harms, as control and incumbency have resisted change.

That gridlock is starting to break. Pressures from climate, technology, and policy are converging to drive a major energy transition. AI and the data centers that enable it are creating massive new demand on already strained grids, while renewables are crossing cost tipping points that allow for democratized access and scale; in the first half of 2025, nearly 90% of new U.S. generation capacity came from wind and solar.

The challenge is that our energy infrastructure is still dominated by fossil fuel combustion, and it is deeply inefficient. Grid-scale combustion wastes 50–60% of input energy as heat before it ever reaches transmission lines. In parallel, industrial heat is largely furnished by boilers and furnaces, onsite combustion-driven systems with no grid tie-ins or existing electrification pathways, that lose 20–50% of potential energy depending on design. Together, these losses mean that industrial process heat accounts for 20–25% of global final energy consumption and roughly 20% of global CO₂ emissions, making it one of the largest and most carbon-intensive segments of the economy. This leaves industrial heat in a particularly difficult position: the grid is slowly decarbonizing, but legacy onsite systems remain locked into fossil fuels, making efficiency gains and emissions cuts harder to realize.

Yet this segment has been slow to electrify. Because industrial systems were designed around direct combustion, and change is often slow, they have not been able to benefit from the efficiency, cost savings, and flexibility of electrified processes. Grid tie-ins, however, make these systems fuel-agnostic: once electrified, operators can take the cheapest electricity or tailor their purchase plan for carbon intensity, price, and timing, creating flexibility and future-proofing that combustion systems cannot offer. Now, just as the technologies to electrify and store heat are maturing, the growth of AI and data centers is taxing grid infrastructure while absorbing vast amounts of new renewable electricity. These digital loads integrate naturally with the grid and take priority in interconnection queues, while industrial heat remains structurally disadvantaged.

Thermal energy storage (TES) is emerging to close that gap. Just as solar and wind reshaped generation over the last decade, TES is poised to reshape how we store and deliver energy as heat: cheaply, cleanly, and reliably. TES already underpins district heating in Finland (Polar Night Energy’s “sand battery”) and is replacing oil boilers in food processing (Elstor’s 10 MWh, 180 °C steam-on-demand system at Herkkumaa Foods, saving $140k and 790 tCO₂ per year). At the high-temperature frontier, Rondo’s brick-based battery in Thailand now powers cement production at over 1,000 °C, demonstrating scalable, zero-carbon industrial heat. These deployments, from food processing to cement, signal the same shift: thermal energy storage is emerging as the bridge between cheap clean generation and the hardest, most carbon-intensive heat loads in the global economy.

2. What TES Is (and Isn’t)

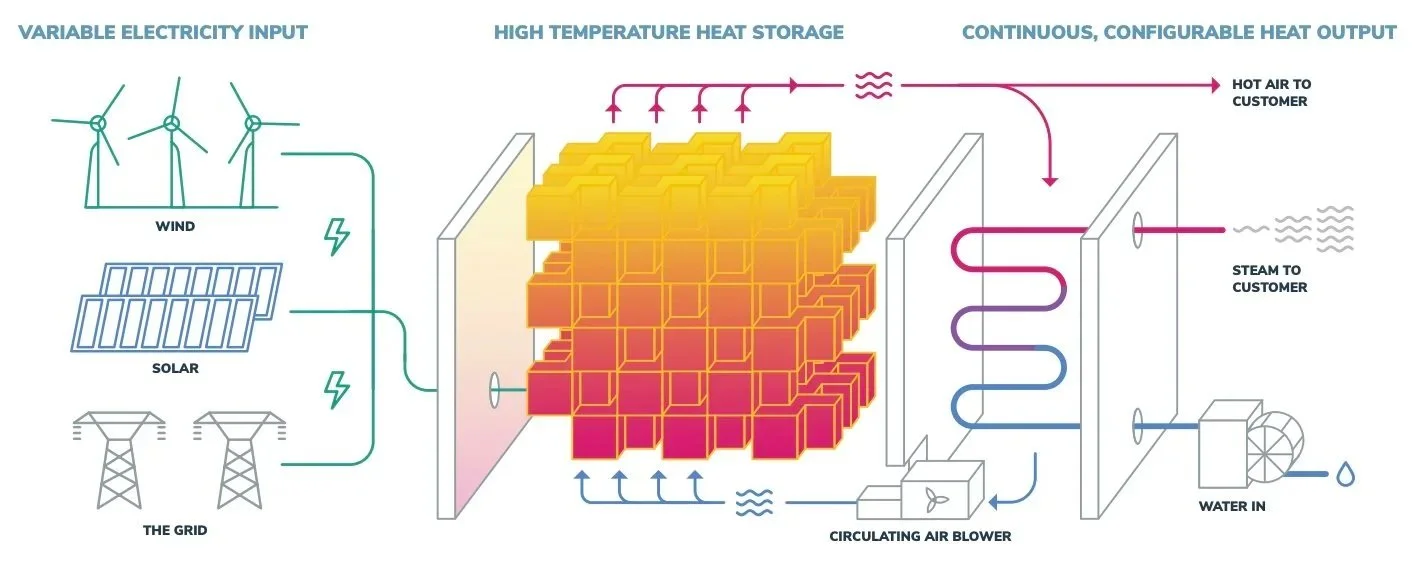

TES is, at its core, a way to capture energy as heat or cold for use later. Unlike batteries, which store electricity, TES is purpose-built for the form of energy that actually drives most of the global economy: heat. Because nearly two-thirds of final energy demand worldwide is for heating and cooling, TES operates in a fundamentally different space than electrochemical storage. For industrial process heat, 66% of applications require heat below 300 °C, a segment that existing technologies are positioned to serve well; however, heating becomes incrementally harder with each degree above ambient temperature, so the 33% of “high temp” applications account for 50% of emissions in the segment.

A quick taxonomy:

Low-temperature TES (<200 °C): hot-water tanks, chilled-water systems, ice storage, and phase-change materials (PCMs). These are widely used for building heating/cooling and in light industrial settings such as brewing or pasteurization.

Medium-temperature TES (200–400 °C): solid media like bricks, sand, or salts that can store heat for processes requiring steady steam or moderate industrial heat. These are well-suited to sectors like food processing, chemicals, and pharmaceuticals.

High-temperature TES (>400 °C): materials such as refractory bricks, graphite, or molten salts that can reach well over 1,000 °C, enabling applications in cement, steel, and glass production.

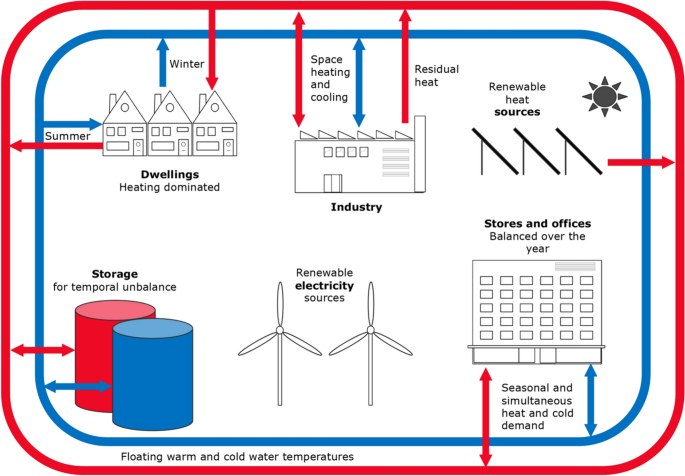

Within the low heat bracket is a category for district heating and cooling, large-scale residential and commercial deployments typically in dense urban environments that help shift season heat loads for comfort in living spaces. These large-scale systems include aquifer thermal storage (ATES), borehole fields (BTES), and pit thermal storage (PTES). The size of these systems is typically immense, allowing the banking of thermal energy over months rather than hours or days, often balancing summer and winter loads in district heating and cooling networks.

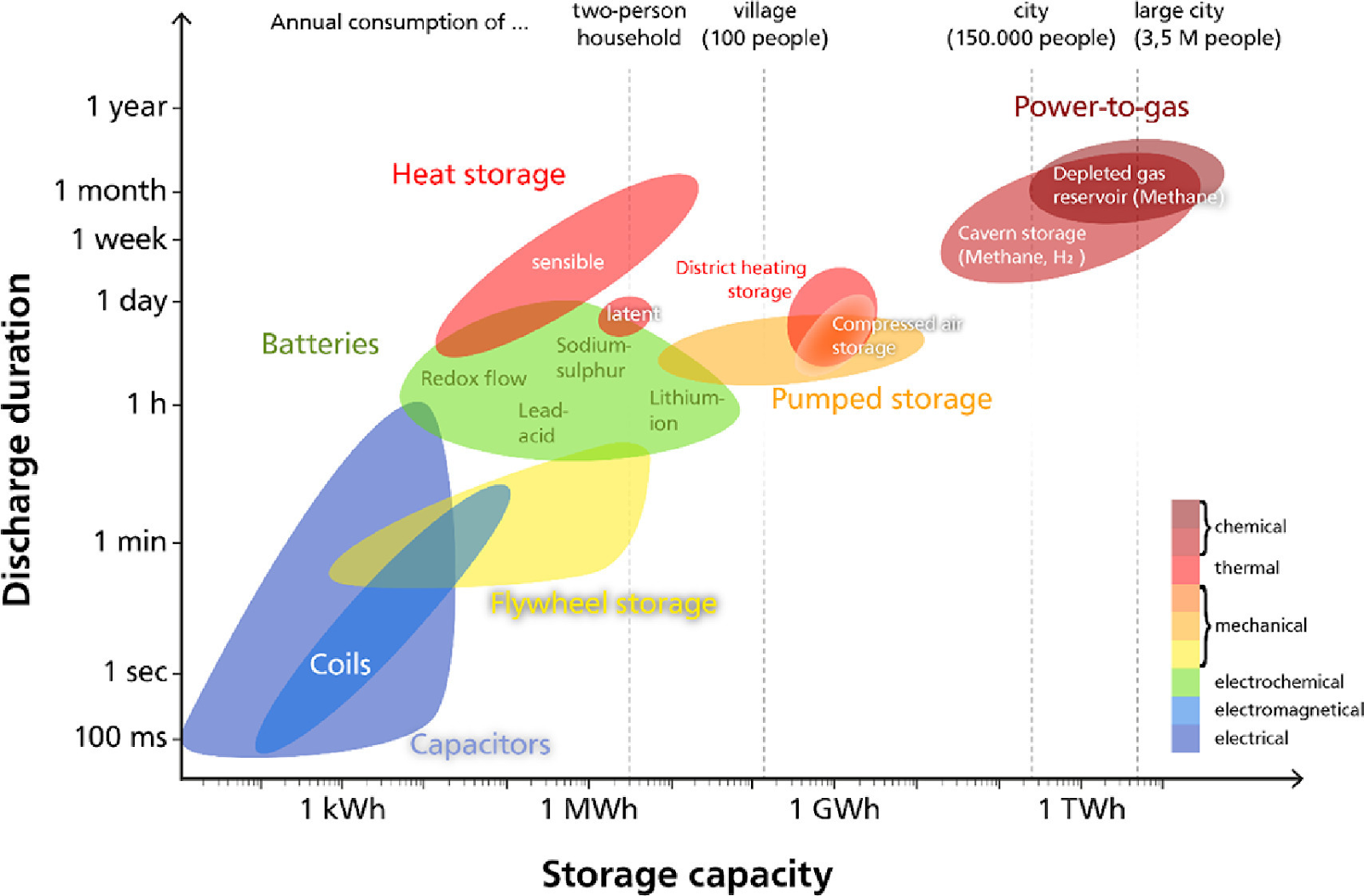

Across these categories, TES stands out for its ability to deliver heat more cheaply and at larger scales than almost any other option. On a cost basis, TES offers ultra-low expense per kilowatt-hour of heat stored, and because it relies on simple physical media such as water, sand, bricks, or salts, systems can operate for decades with little degradation. Unlike lithium-ion batteries, which shine in short-duration and high-cycle applications, TES is uniquely capable of shifting very large amounts of energy not just for hours but for days or even across entire seasons.

At the same time, TES is not a substitute for everything. It cannot provide the fast-response frequency regulation services that lithium-ion batteries offer, nor is it intended to store electricity and return it to the grid at high round-trip efficiencies. Instead, TES thrives where heat itself is the end-use, or where multi-day to seasonal storage complements variable renewable generation. For industries and cities, this makes TES more of a complementary than competitive system to lithium battery systems, addressing the largest, least-electrified share of global energy demand while batteries continue to serve the grid’s short-duration needs.

3. Where TES Fits Best Today

Thermal energy storage is not a monolithic technology; its viability depends heavily on temperature range, geography, policy, and market structure. Although the goals are similar, shifting energy in time to provide reliable heating or cooling, the requirements, enabling technologies, materials, and compatibility with existing infrastructure differ dramatically across temperature bands. Policy support also shapes outcomes: carbon pricing, fuel costs, and incentive structures can make the same technology mature in one geography and nascent in another. Understanding these distinctions is essential, because each band represents a very different competitive landscape, investment profile, and decarbonization pathway.

Low-Temperature (<200 °C)

Status: Mature and competitive in Europe, where heat pumps paired with TES are widely deployed in district heating, buildings, and light industry. In the U.S., adoption remains limited and scattered.

TES Role: Acts as a buffer for heat pumps, storing hot or chilled water and smoothing demand. Enables smaller electrical interconnections compared to large e-boilers, reducing grid bottlenecks and capex.

Context: Europe’s policy drivers — carbon pricing, high gas costs, efficiency mandates — have accelerated deployment. In the U.S., cheap gas, flat tariffs, and uncertain incentives leave the space underdeveloped, with projects only penciling under real-time pricing (RTP) or cheap renewables.

Outlook: Continued crowding and incremental innovation in Europe; slow but growing uptake in the U.S. as tariffs shift, interconnection challenges mount, and corporate decarbonization targets increase demand for clean hot water and space/process heating.

Medium-Temperature (200–400 °C)

Status: Underserved globally, with few standardized offerings. Applications include food processing, chemicals, fermentation, and pharma — all needing steady steam or batch heat at moderate temps.

TES Role: Key enabler in hybrid systems that combine high-temperature heat pumps, TES, and e-boilers to provide flexible, dispatchable steam.

Context: Fossil boilers dominate today, but efficiency penalties and carbon intensity are high. No dominant vendor or technology yet — which leaves white space for modular TES packages that could drive cost curves similar to solar and batteries.

Outlook: The near-term sweet spot for TES investment and deployment. Standardized, modular systems will determine how quickly this band scales, with policy support in Europe and RTP/renewable co-location in the U.S. shaping economics.

High-Temperature (>400 °C)

Status: Early-stage and high-risk. Demonstration projects by Antora, Rondo, Elstor, and others prove feasibility in cement, steel, and glass.

TES Role: Provide >1,000 °C continuous heat from renewable electricity, directly displacing coal and gas in heavy industry.

Context: Deployments today are bespoke and capital-intensive, with few standardized pathways. Economics hinge on cheap renewable inputs, carbon pricing, and corporate willingness to back first-of-kind projects.

Outlook: Unavoidable for deep decarbonization of industry but likely to remain a long-horizon, policy-driven market. Early movers can capture strategic positioning, but broad adoption will depend on demonstration success, standardization, and stronger carbon cost signals.

Across all temperature bands, economics are defined by the spark gap, the effective difference in cost for usable heat between electric systems and legacy fossil combustion. In the U.S., electricity is often three to four times more expensive than gas, while in Europe the gap is narrower and carbon pricing adds another €11–13/MWh to fossil fuels. TES helps narrow this divide by offering value that extends beyond simple fuel substitution: grid balancing, demand-charge avoidance, and resilience against interruptions.

In a world of “cheaper energy but pricier wires”(credit friend Duncan Campbell for one of my favorite reads), colocated renewables and even emerging nuclear builds strengthen the case for TES by reducing dependence on costly transmission upgrades and feeding electricity directly into onsite storage. At the same time, business models are evolving: Heat-as-a-Service shifts capex into opex, while integrated TES + heat pump packages give customers turnkey pathways to decarbonize with lower risk.

Taken together, these dynamics show that TES is not a marginal add-on but has the potential to be an increasingly central element in how heat will be delivered across industries and cities. The question now is less about whether TES has a role, and more about how quickly its development trajectory and modularity can unlock scale.

4. Development Trajectory & Modularity

Thermal energy storage today mirrors the early days of other clean energy transitions. Low-temperature TES is quite mature, already embedded in commercial buildings and district networks. Medium-temperature systems are moving from pilots into early scaling, particularly in food, pharma, and chemicals. High-temperature TES remains in the pilot and demo stage, where projects like Antora’s carbon-block storage or Rondo’s brick battery are proving feasibility but not yet scaling.

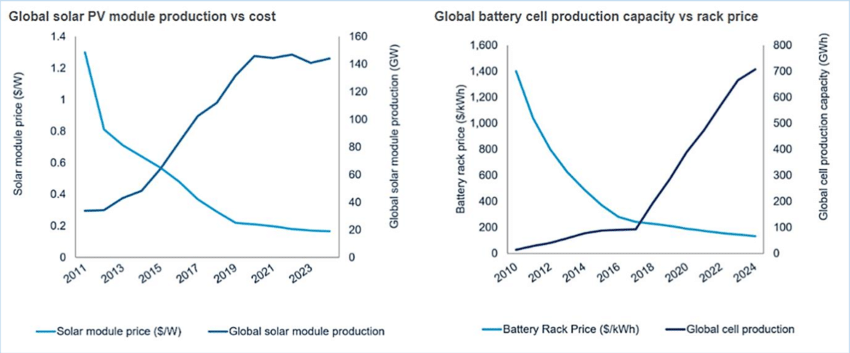

The critical enabler for the next wave is modularity. Standardized MW-scale packages reduce design complexity, accelerate deployment, and simplify maintenance. Just as solar PV moved from custom projects to repeatable modules, TES will only develop competitive cost curves and reach rapid adoption once systems are manufactured and deployed at scale rather than engineered anew for every deployment.

Parallels with solar PV and lithium-ion batteries are instructive: both technologies began as expensive, bespoke solutions serving niche markets. Once modularity and volume manufacturing took hold, learning rates took over and costs collapsed which in turn drove further acceleration in adoption. TES is poised for a similar transition, not because its underlying physics are complex, but because its validation steps lie in integration: grid-aware controls, tariff-responsive planning, and business models that spread risk and capital costs.

The problems that must be addressed for TES to move beyond pilots are less about core science and more about bankability and replicability, even more so than the solar and wind systems that preceded TES. Developers and customers need confidence in performance, standardized warranties, clear tariff signals, and insurance backing. The markets most likely to lead are those with strong policy support and high fossil heat costs: Northern Europe, select U.S. RTP regions, and industrial clusters with access to cheap renewables. What will accelerate adoption most is policy that properly prices emissions and supports lower-risk financing. Even modest adjustments — valuing carbon at its true risk cost, clarifying incentives, or de-risking capital — can shift the viability horizon forward by years. These policies don’t just unlock local projects; they create kingmaker markets where early operators and investors build expertise ahead of peers elsewhere. As deployments in these environments prove out, they generate the templates and confidence that other geographies and sectors will follow.

5. Market Developments & Investment Landscape

Thermal energy storage is moving from theory to validation, with a handful of deployments opening new frontiers. In Europe, district heating and cooling systems have gained momentum, with large-scale seasonal storage proving the concept at city-scale. Elstor’s 10 MWh steam-on-demand unit in Finnish food processing demonstrates TES replacing fuel oil in a commercial setting. Most notably, Rondo’s brick-based battery for cement in Thailand represents the first real foray into heavy industry at >1,000 °C, signaling the burgeoning frontier of high-temp TES to decarbonize one of the global economy’s hardest-to-abate sectors.

Constraints remain unevenly distributed. Site specificity and permitting slow adoption in urban district systems, while U.S. policy uncertainty around IRA/ITC eligibility makes bankability challenging for industrial projects. Insurers and EPCs remain cautious, which raises costs and lengthens timelines. These frictions matter most for mid- and high-temperature deployments, where capital requirements are larger and standardization is still emerging.

At the same time, novel niches are emerging where TES fits naturally. Bio- and precision fermentation processes are batch-driven and steam-intensive, making them strong candidates for hybrid TES + high-temp heat pump systems. Data centers represent another opportunity: rejected cooling loads can be captured for use in district heating, with TES balancing seasonal mismatches.

For investors, the landscape is uneven but promising. The headline pilots prove TES can work in food, urban networks, and even heavy industry — and each represents an entry point for scaling. The niches may not deliver the biggest volumes immediately, but they provide faster validation and sharper returns for early movers. For now, the winners will be those who can identify which markets validate first, and use those footholds to expand into sectors where barriers remain higher.

6. Levers to Shift Viability

The trajectory of TES will be shaped less by physics than by the policy and market environments in which it operates. Policy determines the speed; markets determine the form.

On the policy side, Europe has been clear and consistent. The EU ETS and CBAM steadily raise the cost of fossil heat, while targeted incentives for industrial heat pumps and district heating make TES adoption bankable. In the U.S., by contrast, the path has been uneven. IRA-era tax credits (48/48E) opened the door to TES and hybrid electrification, but ambiguity around whether process heat qualifies has slowed uptake. With a renewed “drill-baby-drill” posture under the Trump administration, direct attacks on TES may be unlikely, but efforts to weaken renewables, slow interconnections, or favor fossil fuel expansion make the economics of TES harder to realize. The effect is policy whiplash: short bursts of progress followed by stalled bankability, leaving U.S. deployments dependent on states, utilities, and corporate buyers to drive momentum or allow it to stall, leaving US interests and leadership by the wayside.

Markets provide their own levers. RTP, bilateral PPAs, and demand-charge structures can dramatically improve TES economics by allowing systems to capture low-cost renewable hours and avoid expensive peaks. This is why regions like CAISO, ERCOT, and NYISO are proving ground zero for TES in the U.S., even as national policy remains inconsistent. Grid dynamics also matter: the surge of AI and data centers is absorbing both interconnection capacity and cheap electrons, paradoxically making behind-the-meter TES more valuable as a hedge against congestion and volatility.

Finally, TES must be viewed in the context of parallel pathways. Electrochemical batteries will compete for arbitrage windows, while hydrogen — including early “white hydrogen” exploration — may emerge as a rival source of high-quality industrial heat. TES will not win every contest, but where heat is the end-use, TES is often the more efficient and durable option.

What accelerates adoption most is not a breakthrough in materials, but confidence: clear tariff signals, standardized warranties, de-risked capital, and credible policy frameworks. Even modest adjustments to markets and regulations can accelerate TES forward by years. As mentioned earlier, it is important to recognize that these adjustments can trigger cascading advancements; they create kingmaker markets, where early operators and investors gain expertise that others must later buy or copy. As these markets validate TES, they generate the playbooks that other geographies and sectors will inevitably follow.

7. Community and expert insights

In conversations with community members, experts, and front-line operators, the perspectives have been clear and consistent, and they reinforce the themes of this analysis.

One expert put it bluntly: “low-temperature is already solved.” With heat pumps and TES widely deployed in Europe, that market is mature and increasingly competitive. The real white space lies in mid- and high-temperature applications, where costs remain uncertain and policy signals have the chance to accelerate the pace of adoption.

Another emphasized that “modularity matters.” Today’s systems are often engineered one-off, raising costs and slowing adoption. Standardized, MW-scale packages — designed for replication, easy maintenance, and predictable performance — will be essential for TES to achieve the cost curves that enabled solar and batteries to scale.

A final expert reminded us, “district heating and cooling needs heat pumps.” TES almost never stands alone; it works as part of an integrated system with heat pumps, concentrators, or boilers. Viewing these assets holistically, will be critical for both policy design and market adoption.

Taken together, these insights echo a central point: TES is not a single technology or market, but a segmented and integrated set of solutions. Its role, economics, and competitive dynamics differ sharply across temperature bands, and success will depend on matching the right system to the right application.

8. Closing: The Investor/Founder Lens

Thermal energy storage should not be seen as one technology and market, but as a spectrum of opportunities that map directly to the temperature ranges of heat demand. At the low end, TES is already proving itself in buildings and district systems, especially in Europe, showing how cheap, modular storage can pair with heat pumps to decarbonize everyday heat loads. At the medium range, where food, pharma, and chemical sectors require reliable steam, TES is emerging as the most promising near-term opportunity: a space where modularity, hybridization, and policy support could unlock rapid scaling. And at the high end, in cement, steel, and glass, TES sits at the frontier. These pilots are costly and risky, but they also represent the last mile of industrial decarbonization and the potential to reshape some of the most carbon-intensive industries on the planet.

The implications go well beyond temperature bands. TES is an enabler across sectors: it allows grids to absorb more renewables, cities to balance seasonal heating and cooling, and industries to replace entrenched fossil boilers. Its economics are shaped by tariffs and policy, but its value is broader: cost stability, resilience, and asset flexibility in a world where two-thirds of final energy demand is heat.

For founders, the path forward lies in integration and modularity, finding footholds where TES can slot into existing processes and replicate quickly. For investors, the opportunity is to recognize that TES will not follow a single curve, but several: rapid scaling at the low and medium ranges, and a slower, higher-risk frontier at the top end. Together, these trajectories will define how TES evolves from today’s pilots into a central pillar of the energy transition.

TES at a Glance: Summary by Temperature Band

Low-Temperature (<200 °C)

Status: Mature, especially in Europe (HPs + hot/chilled water TES widely deployed).

Sectoral Fit: Buildings, district heating/cooling, light industry (brewing, pasteurization).

Outlook: Bankable but crowded; U.S. growth tied to RTP tariffs and corporate decarbonization targets.

Medium-Temperature (200–400 °C)

Status: Emerging; pilots moving into early scaling.

Sectoral Fit: Food, pharma, chemicals, fermentation — processes requiring reliable steam.

Outlook: Near-term sweet spot; modular systems and hybrid HP + TES + e-boiler packages could unlock cost curves and rapid scaling.

High-Temperature (>400 °C)

Status: Early-stage frontier; pilots (Antora, Rondo, Elstor) proving feasibility.

Sectoral Fit: Cement, steel, glass, and other hard-to-abate industries.

Outlook: High-risk and capital-intensive, but essential for deep industrial decarbonization; policy and corporate demand will drive first waves.